Sustainable financing among Dutch listed companies continues steadily in 2023

In this 2023 update of our research, it is clear that more AEX and AMX companies are utilizing sustainable financing. Furthermore, the total volume of sustainable financing has also increased from 2022 to 2023. This is the case in both bank financing and capital market financing.

The starting point contains 50 firms listed on the AEX and AMX. The focus is on the 40 non-financial companies, the so-called ‘corporates’[1]. Based on information from Bloomberg, press releases and annual reports we have mapped the development from 2022 to 2023.

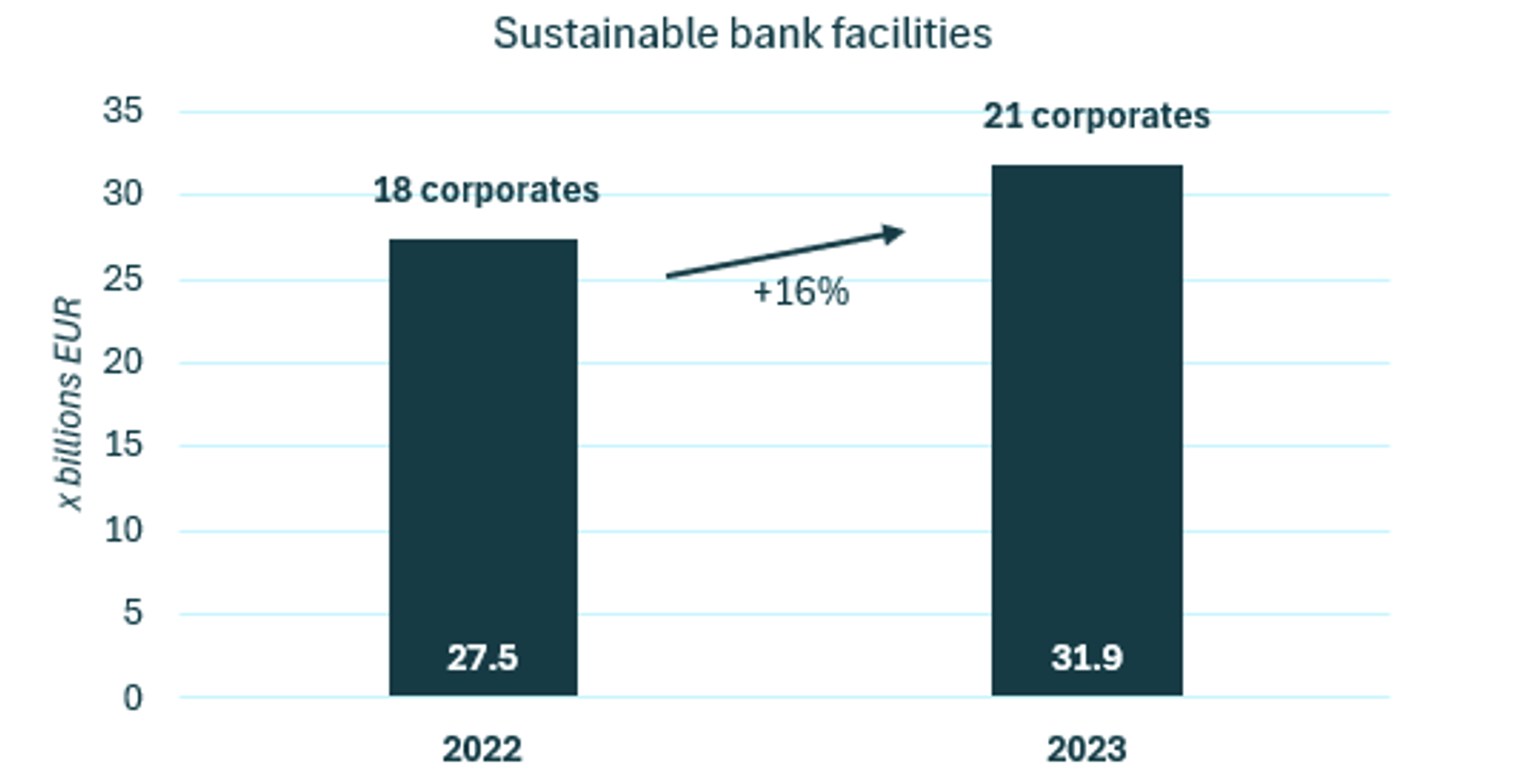

Three new corporates with sustainable bank facilities in 2023

The number of companies with sustainable bank facilities has increased from 18 to 21 by the end of 2023. In total these 21 companies have EUR 31.9 billion in sustainable facilities outstanding compared to EUR 27.5 billion at the end of 2022, marking an increase of over 16%. The facilities of the three new corporates in 2023 are further explained below.

Figure 1: Development of sustainable bank facilities in the Netherlands.

AirFrance-KLM and TKH have secured new Sustainability-Linked Loans (SLLs) which are tied to KPI’s in 2023. The number of companies with such facilities has now risen to 16. The ESG KPI’s of Air France-KLM are linked to CO2 reduction and increased use of Sustainable Aviation Fuel (SAF). For TKH’s new SLL, the KPI’s are as follows: “The sustainability targets in the €625 million multi-currency credit facility are linked to the achievement of TKH’s key ESG targets as set out in our Accelerate 2025 strategy program, relating to CO2 intensity (scopes 1 and 2), waste reduction, and gender diversity within our executive and senior management teams.”

The third newcomer in 2023 is CTP. CTP has secured a Green Loan of EUR 500 million to invest in new sustainable logistics parks. CTP: “…the development of energy-efficient, green-certified, industrial and logistics parks in Bulgaria and Poland.” Furthermore, in 2023 AirFrance-KLM has secured a Green Loan of EUR 640 million to invest in the share of new generation aircraft in the fleet.

Ahold Delhaize, Arcadis, and AirFrance-KLM raise a total of EUR 1.7 billion in new sustainable capital market financing.

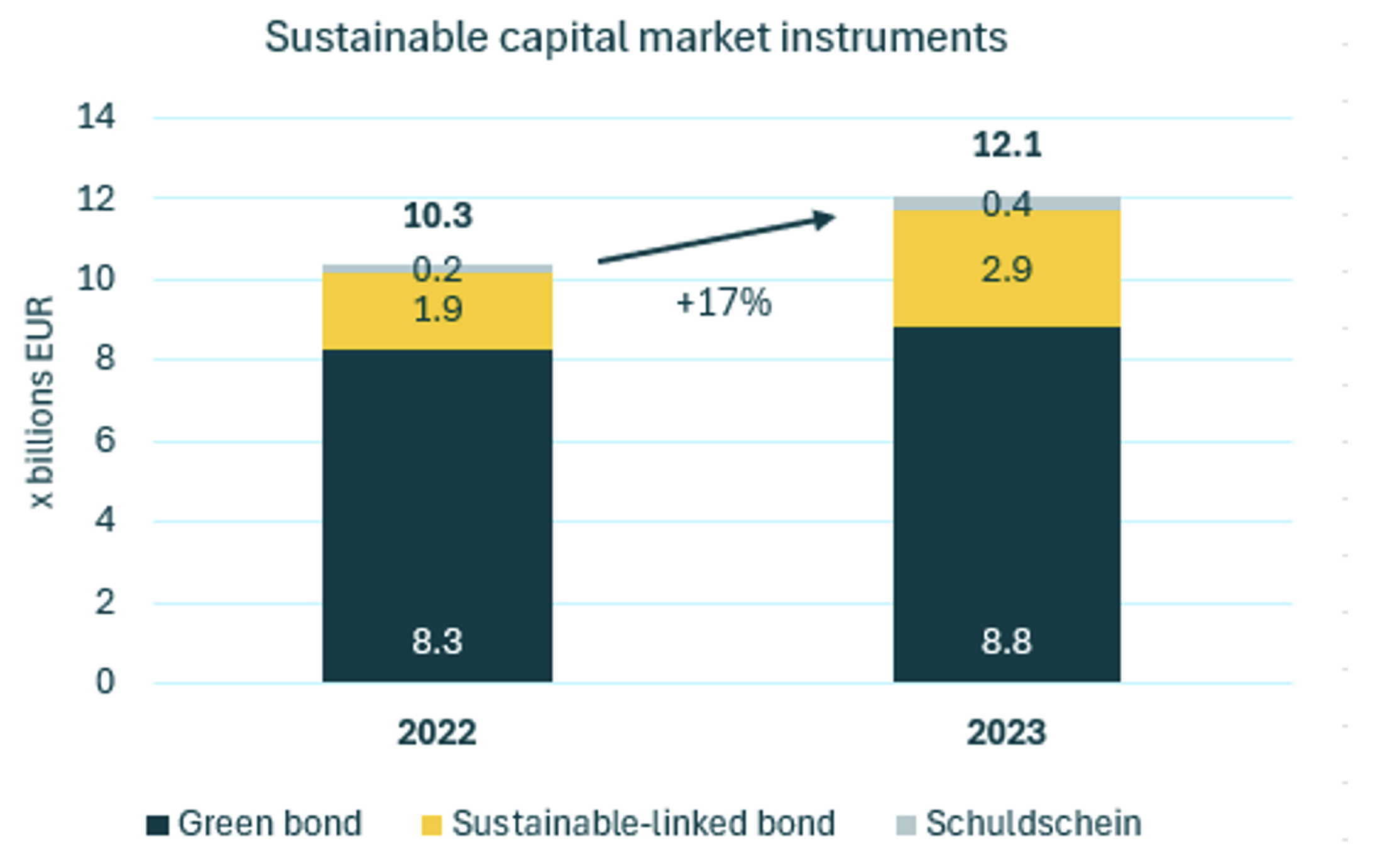

The number of companies with sustainable capital market instruments has risen from 8 at the end of 2022 to 9 at the end of 2023, due to the newcomer Air France-KLM. The outstanding amount has increased by 17%, reaching over EUR 12 billion by the end of 2023.

Figure 2: Development of sustainable capital market financing.

The most common types of financing in sustainable capital markets are Green Bonds, Sustainability-linked bonds (linked to ESG KPI’s) and Sustainability-linked Schuldschein loans. As shown in Figure 2, Green Bonds are by far the largest category.

As is the case with sustainable banking financing, Air France-KLM is also a newcomer in sustainable capital market financing. Air France-KLM has issued two sustainability-linked bonds. With these types of bonds, the issuer is “penalized” with step-ups in the coupon rate if the predetermined targets, in this case CO2 reduction, are not met. The two new bond issues from Air France-KLM, each with a total value of EUR 500 million, also have such step-up provisions.

We expect that more and more companies will opt for a sustainability-linked option when refinancing.

Additionally, Ahold Delhaize issued its first Green Bond in 2023, bringing the total number of companies with this type of instrument to 6. Ahold Delhaize was already active in the sustainable capital market with sustainability-linked bonds. The EUR 500 million raised with this Green Bond will be used for projects in the following categories, according to Ahold Delhaize: “green buildings, renewable energy, energy efficiency, clean transportation, and pollution prevention and control.”

The ever-increasing importance of sustainable financing

We can conclude that there was steady growth in sustainable financing among Dutch listed companies in 2023. We expect this trend to continue in the coming years.

With the advent of the EU Taxonomy and CSRD reporting obligations the importance of sustainability is becoming increasingly significant for both corporates and financiers. In addition, European banks will be required to report the Green Asset Ratio (GAR, aimed at further greening their credit portfolios in line with the EU taxonomy) for the first time in 2024. Sustainability and ESG are high on the agenda in virtually all financing projects we oversee.

Previous publication

The 2022 research provides a further explanation about the different types of sustainability instruments and the most common ESG-KPI’s. Click on the publication below for the 2022 research.

[1]The financial companies excluded from the study are: ABN AMRO, Adyen, Aegon, ASR, EXOR, ING, NN Group, Allfunds Group, Flow Traders, Van Lanschot Kempen.