Essentials in Artificial Intelligence – Building Blocks for Treasury

Artificial Intelligence (AI) has rapidly evolved from a tool for analyzing large datasets (Machine Learning) to a mainstream technology with applications like Generative Pre-trained Transformers (GPTs). For Treasury, the Artificial Intelligence Journey is just beginning.

While AI offers use cases in areas like Cash Flow Forecasting (e.g., predicting future cash flows with greater accuracy) and managing FX risk (e.g., automating hedging strategies), many organizations are still exploring AI’s potential benefits.

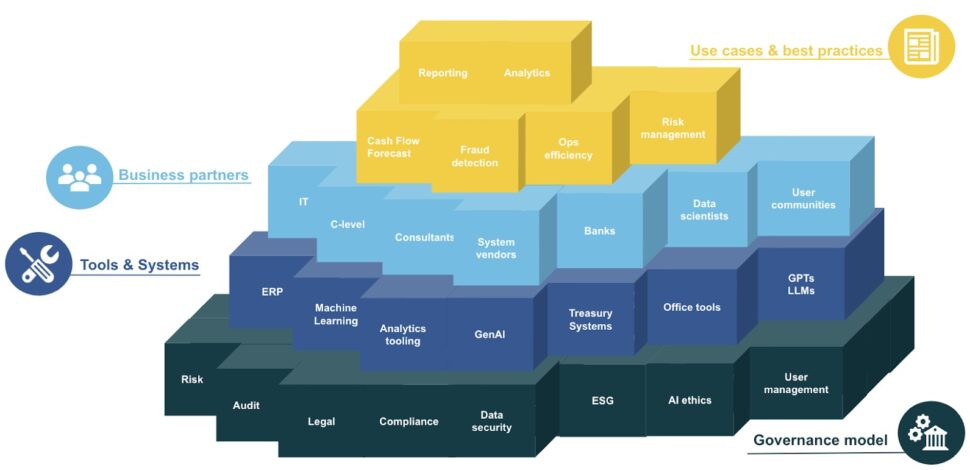

To guide this exploration, Orchard Finance has outlined the essential elements of AI in Treasury.

Practical applications and best practices

Practical use cases and best practices are at the pinnacle, providing Treasury teams with real-world examples of AI applications, their benefits, and implementation strategies. One such successful example is ASML’s DACT award-winning case.

The success of these use cases rests on a solid foundation of Business Partners (both internal and external, including specialist vendors), robust Tools & Systems, and a clear Governance model.

From Machine Learning to integrated AI solutions

Traditionally, AI in Treasury focused on Machine Learning for big data analytics. With the advent of Large Language Models (LLMs) and GPTs, Treasury Systems are increasingly integrating AI solutions (both machine learning and LLMs) into their existing platforms, rather than developing entirely new tools. This trend mirrors what we see in office automation, such as Microsoft’s integration with Copilot and Google embedding Gemini.

We believe the most effective AI strategy for Treasury is to combine Machine Learning for in-depth data analysis with Large Language Models (LLMs) like GPTs for generating actionable insights and clear reports, ultimately leading to better-informed decisions.

Governance: an essential prerequisite

A strong governance model is crucial for a successful and responsible adoption of AI in Treasury. Key considerations include:

- Data security and privacy policies

- Consultation with risk audit and legal teams

- Data sourcing and potential biases in training data

- Company guidelines for using GPT model

ESG considerations and AI ethics are important aspects, even if their direct impact on Treasury might seem limited. In the broader context of AI adoption, these are highly relevant topics. On the one hand it is expected that AI can support in streamlining ESG reporting, on the other hand, concerns have been raised on how the use of AI increases electricity and water consumption and has a potential huge impact on labor.

Regulation: the importance of the EU AI Act

Understanding regulatory policies like the EU AI Act is essential for selecting appropriate AI tools. The Act sets boundaries for AI deployment in society, including banning high-risk applications like those that manipulate behavior and addressing concerns around algorithmic bias and accountability. These regulations are closely tied to AI ethics, which emphasise responsible, transparent, and fair use of AI technologies.

AI in Treasury: a strategic development

Adopting AI in Treasury is a journey, not a sprint. While uncertainties exist, it’s imperative for Treasurers to include AI in their future plans and roadmaps.

This article was written by:

Ariane Hoksbergen

Ariane Hoksbergen

Partner Treasury Technology